DIGITAL BANKING FAQ

HAVE QUESTIONS? WE HAVE ANSWERS!

Online Banking. Bill Pay. Mobile Banking and more! Find answers to your questions below.

-

You can enroll in Online Banking by visiting the Enrollment page of our Online Banking website.

You will need to provide your member number, with the added 0 at the end, and enter your social security number.

You will then be asked to select a User ID, password and set up a verification phone number and challenge questions.

-

When you enroll in Online Banking, you are required to register a phone number with our system and choose/answer security questions. Setting up these security measures helps us authenticate your identity and keeps your account safe.

When logging into Online Banking, you may be asked to supply an access code, which we will send to your registered phone, or to answer the security questions if you are accessing Online Banking from a PC or device that has not been previously registered with our system. These verification measures may also be employed if a transaction is made that is suspected to be out of the ordinary for you.

Visit our Online Banking page for more details.

-

If you have already enrolled in Online Banking, then you are all set! All you need to do is download our Mobile Banking app from Google Play or the Apple App store. You may then use your Online Banking User ID and password to log in.

Visit our Enrollment page to get started with Online Banking today.

-

You must have a checking account opened and be enrolled in Online Banking before you can start using our Bill Pay service.

Once you are ready, simply log in to Online Banking and select Pay Bills from the top of the page.

-

You can reset your password by using the Forgotten Password service on our Online Banking website.

-

You can recover your User ID by using the Forgotten User ID service on our Online Banking website.

-

It is possible that you have tried logging in to many times and have been locked out for security. If this is the case please contact us to be unlocked.

If it has been 6 or more months since the last time you signed in, then it is possible your profile has been deactivated for security. If you believe this is the case you will need to re-enroll.

-

You can find your Electronic Statements by logging into our Online Banking website. Once you have logged in, click on the account you would like to view Electronic Statements for. From the Accounts Details page, click on the Online Statements link. You will be directed to our Electronic Statements website, where you will find a list of monthly statements.

Visit our Enrollment page to get started with Online Banking today!

-

Internal Transfers: The limit for a single transfer is $5,000. The daily limit for transfers is also $5,000.

External Transfers: The individual transfer limit is $5,000 for Standard delivery and $2,000 for Next Day delivery. The daily limit for external transfers is $5,000 for Standard delivery and $2,000 for Next Day delivery

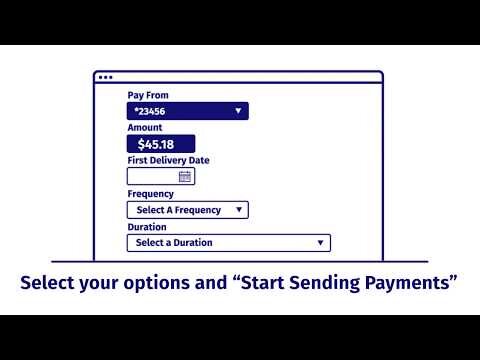

Bill Pay: The limit for a single payment is $5,000. The daily limit for payments is also $5,000.

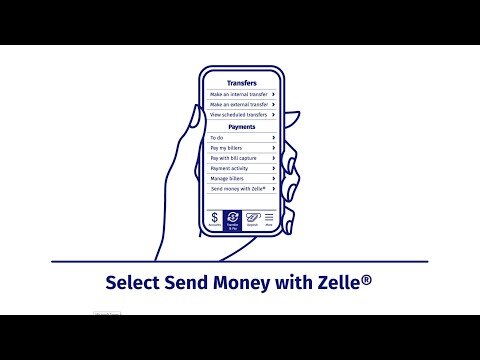

Zelle Payments: The transaction and daily limits for sending money is $1,000 for all delivery methods. The limit for requesting money is $2,000 per transaction, per day.

-

Mobile Deposit has a deposit limit of $5,000.00. When using this feature, make sure that the photo is clear and that you have the following statement written under your signature “For Mobile Deposit only to FSFCU”.

-

Whether it's saving you a trip to the ATM or taking out the guesswork of divvying up the lunch tab, Zelle is a fast, safe and easy way to send and request money. Funds are sent directly to the recipient's account in a matter of minutes, and all you need is the recipient's email address or U.S. mobile phone number.

Visit our Zelle page for more information or the Zelle FAQ if you are looking for something more specific.

-

Log in to Online Banking and go to the Transfers option at the top of the page. Once you are on the Transfers page, click on the External Transfers link to the right of the screen. This will take you to TransferNow.

TransferNow allows you to connect to your accounts at other financial institutions and transfer money back and forth.

Find out more about External Transfers.

-

Via our Mobile app, you can lock or unlock your card if you suspect fraud or misplace your card. You can even report lost and/or stolen cards without ever having to call a customer service number. Even limit transactions by location, merchant, and transaction type to control how your card is used. Plus, set up alerts to stay informed.

Helpful Digital Banking Tutorials

If you live, work, worship or attend school in Comanche County, you may be eligible for membership.

Become a member today and start experiencing the credit union difference.

For information regarding fees, please refer to our Fee Schedule